Life Insurance Company for Dummies

Little Known Facts About Senior Whole Life Insurance.

Table of ContentsThe Ultimate Guide To Life Insurance Companies Near MeThe Single Strategy To Use For Life Insurance Quote OnlineThe Greatest Guide To Life Insurance Companies Near MeUnknown Facts About Life Insurance CompanyLife Insurance Companies Near Me Fundamentals Explained

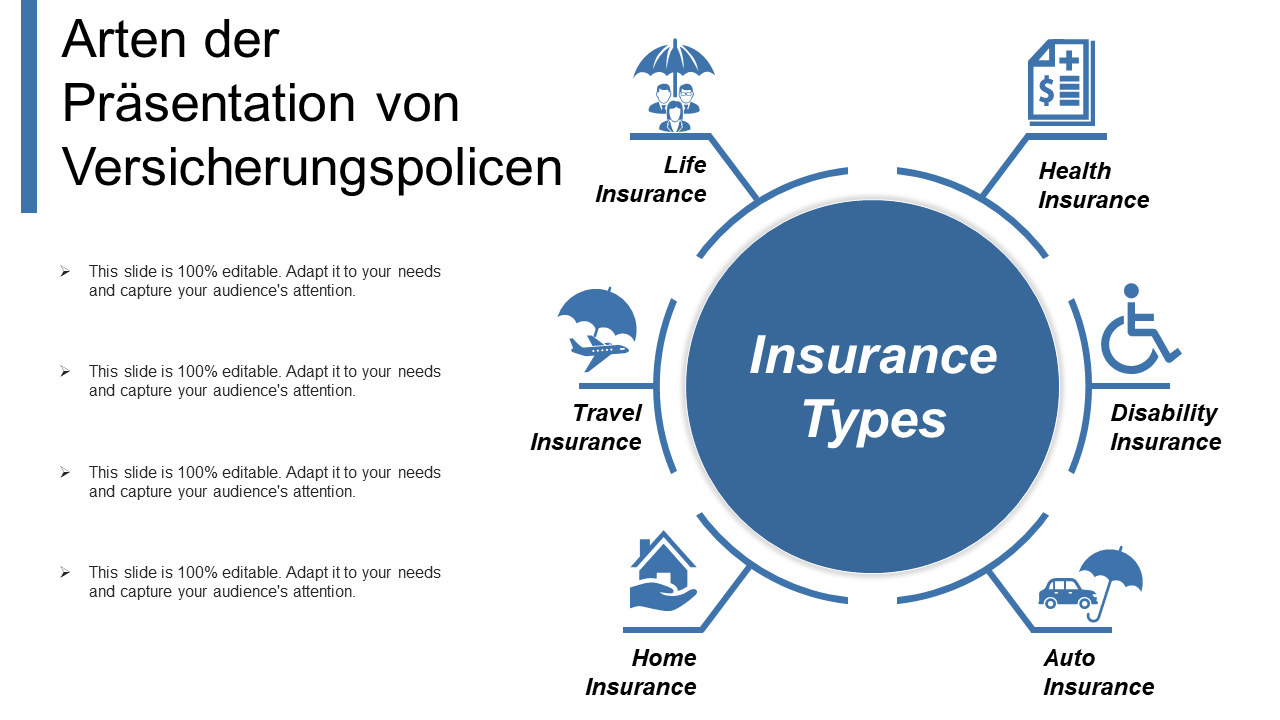

1 Definitions and also Kinds of Insurance Coverage Learning Goals Know the basic kinds of insurance policy for people. Name as well as describe the various kinds of organization insurance coverage. A contract of reimbursement.The individual or firm guaranteed by a contract of insurance coverage. (sometimes called the guaranteed) is the one who gets the repayment, except in the case of life insurance coverage, where repayment goes to the recipient named in the life insurance policy agreement.

Life Insurance Things To Know Before You Buy

Every state now has an insurance coverage division that manages insurance prices, policy requirements, books, and various other facets of the sector. For many years, these divisions have come under attack in many states for being ineffective as well as "captives" of the industry. Huge insurers run in all states, and also both they and also consumers have to compete with fifty different state governing systems that give extremely different degrees of security (Cancer life Insurance).

We start with an overview of the sorts of insurance, from both a customer and an organization perspective. We examine in greater information the three most essential types of insurance coverage: residential or commercial property, obligation, and life. Public and Private Insurance policy Sometimes a difference is made between public as well as private insurance policy. Public (or social) insurance policy includes Social Safety, Medicare, short-term impairment insurance coverage, and so forth, funded through federal government strategies.

The emphasis of this chapter is private insurance policy. Types of Insurance Coverage for the Individual Life Insurance policy Life insurance coverage supplies for your household or some various other called beneficiaries on your fatality. Life insurance coverage with a fatality advantage yet no built up financial savings.

Some Known Questions About Whole Life Insurance Louisville.

Health Insurance Medical insurance covers the expense of a hospital stay, visits to the medical professional's office, and also prescription medications. Life insurance quote online. The most useful plans, supplied by many companies, are those that cover one hundred percent of the costs of being hospitalized and also 80 percent of the fees for medicine and a doctor's services. Typically, the plan will contain a deductible amount; the insurance firm will not pay until after the deductible amount has been gotten to.

Handicap Insurance coverage A handicap policy pays a specific portion of a worker's incomes (or a repaired sum) weekly or regular monthly if the worker becomes unable to function through ailment or a crash. Premiums are reduced for policies with longer waiting periods before payments need to be made: a plan that begins to pay an impaired worker within thirty days may set you back two times as long as one that delays settlement for six months.

Our Term Life Insurance Louisville Diaries

Vehicle Insurance coverage Vehicle insurance is perhaps one of the most commonly held kind of insurance - Life insurance Louisville KY. Auto plans are called for in at the very least minimal quantities in all states. The typical auto policy covers responsibility for physical injury as well as residential or read the full info here commercial property damages, clinical payments, damage to or loss of the automobile itself, and attorneys' costs in instance of a suit.

A personal responsibility policy covers several sorts of these dangers and also can give protection in excess of that given by homeowner's as well as vehicle insurance coverage. Such umbrella insurance coverage is normally fairly low-cost, perhaps $250 a year for $1 million in liability. Sorts Of Organization Insurance Coverage Workers' Settlement Virtually every organization in every state have to guarantee against injury to workers at work.

The Main Principles Of Kentucky Farm Bureau

Malpractice Insurance Policy Professionals such as doctors, attorneys, as well as accounting professionals will often acquire negligence insurance policy to protect against insurance claims made by unhappy people or customers. For doctors, the cost of such insurance coverage has actually been increasing over the previous thirty years, mainly as a result of bigger jury awards versus physicians who are negligent in the technique of their career.

Liability Insurance Companies encounter a host of threats that might cause considerable obligations. Many types of policies are offered, including policies for owners, property managers, and lessees (covering responsibility incurred on the premises); for suppliers and also professionals (for obligation incurred on all facilities); for a company's products and finished procedures (for responsibility that results from guarantees on products or injuries created by items); for owners and specialists (safety liability for problems created by independent professionals engaged by the guaranteed); as well as for contractual liability (for failing to abide by efficiencies needed by particular contracts) (Cancer life Insurance).

Today, many insurance coverage is offered on a package basis, via solitary plans that cover the most important threats. These are usually called multiperil plans. Key Takeaway Although insurance is a demand for each United States company, and also numerous businesses run in all fifty states, policy of insurance policy has stayed at the state level.